Origins of Breaking Finance's Tools

If you have read our "About Us" page then you know a little bit about where the tools originated, but its important to also understand how to use them properly.

Originally, they were built from scratch to evaluate the Creator's personal financial situation. Given that he was the only user they were very skeletal in appearance with no colors, labeling and certainly no explanation pages. So, to make these useful to others he spent many hours designing them to be user friendly and educational.

All of the tools are easy to use, with little to no excel knowledge required!

General Structure

Home Page Tab

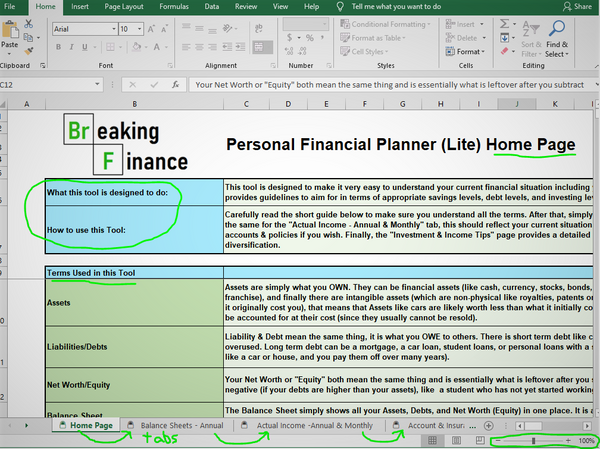

Every one of the tools starts at a "Home Page" tab. This page explains the purpose of the tool, gives a brief 'how to' and includes a relevant financial "dictionary". The "dictionary" is simply a list of key words or phrases that are used throughout that specific excel tool. It offers full explanations & examples to help make sure you understand the concepts before you jump into using the tool.

Navigating Through the Tools

Once you feel you have a solid grasp of the information on the Home Page, you can then begin to use the tool by selecting the next tab at the bottom. Generally, our tools are designed to be filled in from the left tab to the right. Further navigation on the page can be done by scrolling with your mouse and you can adjust the size to fit your screen.

Input Cells

To maximize ease of use across all of our tools the yellow cells are input cells (where you input your values) and all other cells are output cells (built with formulas). As the end user, you do not need to build any formulas or edit any of the excel pages, all this is finished for you! However, if you are a power user you can make edits & alterations to the tools (Full Versions only) to better fit your specific situation.

Evaluating

Once you have filled in each of the cells, the tools will produce outputs that help you see the "big picture" for a given financial situation. This includes everything from understanding Net worth, to debt levels, potential profits/returns, saving/spending %, diversification, how close you are to financial independence etc. Usually these metrics will also include blurbs of additional information regarding ideal/target values or general information about potential types of investments.

Legal

Lastly, each tool has a legal page which includes our copyright and a disclaimer similar to this website's Terms. You accept that this is solely an educational & informational resource designed to empower you to learn about finance and estimate certain financial situations for yourself. The calculations are based on widely accepted financial formulas along with your own assumptions. They are not investment advise.

The Tools

Each of the main personal financial tools come in a free simplified version which locks editing and a full version more advanced version where the calculation pages are unlocked to edit.

The "Personal Financial Planner" is where we would recommend everyone begin as this provides you with the clearest understanding of your current financial situation and covers the most basic financial terms. This tool is very easy to use because all you have to do is fill out a basic questionnaire and it builds your Balance & Income sheets for you!

The "Loan, Lease and Annuity Calculator" calculates the values or payments of loans, leases & annuities. It is especially useful for comparing a car loan vs. lease, and for its "Car investment/cost" guide. This tool also maps out any loan you wish to pay down faster (see when it will be paid off & how much interest you save), and it can help plan a stream of savings or an annuity investment.

The "Personal Investment Tracker" enables you to track your financial investments (stocks, bonds, ETFs, cryptos, options, etc.) aggregated from all of your different accounts onto one sheet. This empowers you to see detailed analysis of your holdings including profits, losses, diversification levels, exposures to specific asset classes, lifetime returns and other critical metrics. Having a holistic view with important insights is a huge advantage typically reserved for the "pros", now easily available to you!

The "Real Estate Investment Analysis Tool" helps you evaluate potential real estate purchases for both your primary residence and investments. There is a quick analysis tool which enables you to compare several properties based on several profit & return metrics using very few inputs. Additionally, there is a full cash flow & income analysis page for properties you want to analyze more deeply. Overall, this tool will help you build a stronger understanding of the real estate market & estimate values of potential purchases.

The "Stock Analysis Tool" is perhaps our most advanced tool due to the difficulty of material. We recommend that you thoroughly understand all financial terms and go through the completed example before embarking on your own. Understanding how stocks are priced and what their intrinsic value might be is a very challenging problem. This tool includes a 2-stage 10 year Discounted Cash Flow (DCF) model, simplified so you can focus on the quality of your assumptions instead of the complexity of the model. It also includes a 10 company comparison page enabling you to perform a pricing analysis. After you have completed both you should have an estimate of the stock's fair value, if its a good potential investment, or if another stock in its industry is actually a better relative value. This tool should only be part of your investment analysis process.

Finally, the "Ultimate Personal Finance Tool" puts together the first four main tools described above into one big excel tool. If you like having all your finances in one place then this is the way to go!

We at Breaking Finance sincerely hope you receive tremendous personal value from utilizing and learning from our resources :)